PayPal shares (NASDAQ:PYPL) is struggling, and you don't have to look far to find examples.

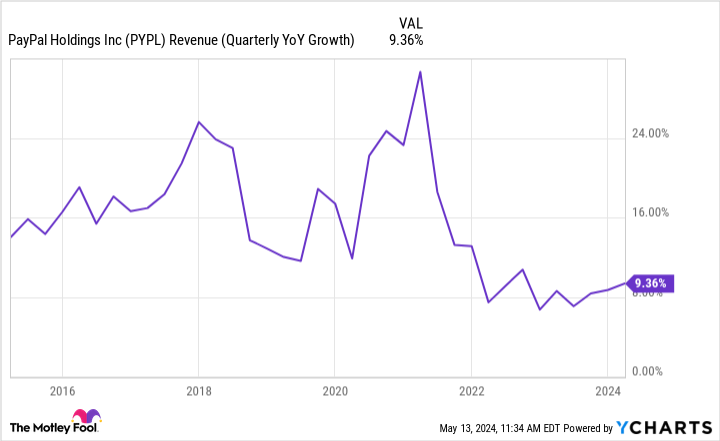

For starters, PayPal's revenue grew at a double-digit rate for years. But over the past few years, the pace of growth has been much more noncommittal, with the company's revenue increasing just 9% in the most recent quarter.

Growth for PayPal has slowed. And here's another problem for the company: the growth it does experience is of lower quality. Much of the growth is due to the unbranded payment solution, which powers some platforms behind the scenes. This has a lower profit margin. So while overall sales are up, profits have barely changed.

PayPal is having problems. But new Chief Executive Officer Alex Chriss is looking past some of them to his Venmo business, where there's one metric that's more than just a struggle: Chriss finds this metric simply unacceptable.

What's wrong with PayPal's Venmo?

Venmo is peer-to-peer financial technology (fintech). The mobile app allows users to connect and send money back and forth, often to share the cost of a meal or similar group activity.

On the earnings call to discuss first-quarter 2024 financial results, here's what Chriss had to say: “$18 billion in net new funds flow into Venmo's platform every month. Eighty percent of those dollars leave within 10 days .” That is simply unacceptable.”

PayPal management apparently wants its users to pay for things from their Venmo accounts, and not transfer balances to other financial institutions to pay from there. The inferred reason for this is that banks can easily make money from customers' balances. But that's exactly why it can be difficult to convince people to keep money in Venmo.

First, Venmo is not a bank and does not offer the same guarantees as traditional bank accounts. Second, bank accounts earn interest – not much, but at least it's something. On the other hand, Money in Venmo doesn't yield anything. In short, there's no reason to carry a Venmo balance. In fact, it's shocking to me that Chriss says it's actually 20% of the money do sits there.

What's the plan?

Before investing in PayPal stock, you should understand what the company owns and how it fits into the bigger picture. In this case, Venmo is responsible for 17% of PayPal's total revenue from a payment volume perspective as of the first quarter. And the platform has 60 million active users every month – not unimportant.

Both the PayPal platform and the Venmo platform largely target the same side of the fintech ecosystem: consumers, not businesses. I noted that Chriss wants users to pay for things from Venmo, but the same can be said for PayPal's core platform as well. To encourage this, the company is introducing its debit card, which will allow the digital-first company to process transactions offline – this is part of Chriss' plan to deal with what he finds unacceptable for Venmo.

In this regard, growth for both platforms is encouraging. In the first quarter, only about 4% of PayPal accounts used the associated debit card. But the number of new debit card users increased by 38% year on year. Venmo saw a 21% increase in debit card users.

What now?

There are some encouraging signs at Venmo, but PayPal faces an uphill climb to get more money to stay on the platform instead of being transferred elsewhere. Investors should pay attention to debit card penetration in the coming quarters as this is a focus of management. Greater use of debit cards could lead to better Venmo revenue generation.

That said, PayPal is still the dominant part of this business, and management has said that 2024 will be a “transition year.” This means it could take some time for overall financial results to show improvement, giving investors plenty of time for now to calmly evaluate PayPal's progress with Venmo.

Should You Invest $1,000 in PayPal Now?

Before you buy shares in PayPal, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and PayPal wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $553,880!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Jon Goyle has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: June 2024 short calls of $67.50 on PayPal. The Motley Fool has one disclosure policy.

PayPal is having a hard time: the new CEO finds this 'unacceptable' was originally published by The Motley Fool