'Audentes Fortuna iuvat', wrote Virgil in his classic epic, the Aeneid. The saying, translated as 'Fortune favors the bold', means that Fortune, the goddess of luck, is more likely to help those who take risks or take action.

The stock market gives us one of the clearest examples of this principle with penny stocks. Listed at $5 or less, these cheap stocks provide an entry point at the bottom, making them real gold for the risk-tolerant investor.

The call is clear. For the same price as one share of a better-known company, investors can buy hundreds of one-cent shares. Furthermore, the fact that even a small price increase can translate into big percentage gains is too attractive for some investors to ignore.

While penny stocks can deliver huge returns, there may be a reason they change hands at such low levels. These names are in challenging times and could get stuck due to overwhelming headwinds or poor fundamentals.

So, how should investors approach a potential penny stock investment? By taking a cue from the analyst community. These experts bring in-depth knowledge of the sectors they cover and substantial experience.

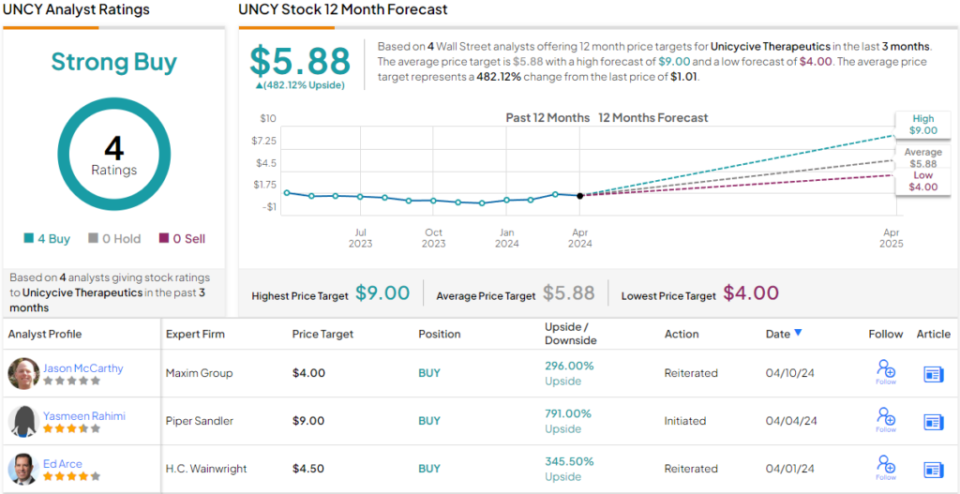

With this in mind we took advantage of TipRanks database to point out two penny stocks getting rave reviews from Piper Sandler, with the firm's analysts predicting a potential rally of more than 300%, setting a $9 price target for each. Compounding the good news, both tickers boast a 'Strong Buy' consensus rating from the rest of the Street. Let's take a closer look at that.

Unicyclic therapies (UNCY)

We'll start with Unicycive Therapeutics, a biotech company focused on the treatment of hyperphosphatemia. This condition is a common side effect of chronic kidney disease (CKD) and is a leading cause of excess death in dialysis patients. Hyperphosphatemia is particularly dangerous because it is symptomless and can only be detected by frequent blood tests. Even when controlled, it still burdens patients; CKD is the chronic disease with the highest 'pill burden' – an average of 19 prescription pills taken by patients daily, even higher than AIDS or congestive heart failure.

Unicycive aims to both treat hyperphosphatemia and reduce the pill burden for patients, with the aim of improving medication compliance and therefore improving medical outcomes. The company's lead drug candidate, oxylanthanum carbonate (OLC), is tailored specifically for this purpose. The drug candidate is a phosphate binder that uses the already known phosphate-binding properties of elemental lanthanum to create a hyperphosphatemia treatment that is more effective, at a lower dose and with smaller pills than current treatments.

The company has completed enrollment in a pivotal late-stage clinical trial conducted in an open-label, single-arm, multicenter, multidose format. The publication of topline data from this study, expected in late 2Q24, marks a critical step forward in Unicycive's journey to transform the treatment of hyperphosphatemia.

In addition to OLC, Unicycive is also developing UNI-494, a novel drug candidate for the treatment of acute kidney injury. This drug candidate has been granted orphan drug designation by the FDA for the delayed graft function of the acute kidney injury indication. Orphan drug designation is an important regulatory step in the development of therapeutics for conditions with a small patient base.

With UNCY shares trading at $1.02, this attractive valuation has caught the attention of Piper Sandler analyst Yasmeen Rahimi, who is optimistic about the potential sales for OLC if it wins approval.

“This micro-cap name is trading at cash and significantly below its value in our view, but we think this hidden gem has significant upside before OLC approval. Specifically, its lead product, OLC, is a proprietary phosphate binding agent currently in late-stage development for hyperphosphatemia, which universally affects patients with chronic kidney disease. CKD is a blockbuster market with more than 500,000 people on kidney dialysis (~80% on phosphate binders), which will generate sales of ~$1.125 billion in the US in 2021 ($2.5 billion globally). Given that ARDX (hyperphosphatemia comp) is trading at a market cap of ~$1.71 billion, we believe this underlines that UNCY is undervalued and under investors' radar,” Rahimi opined.

“Accordingly,” Rahimi summarizes, “we are bullish on UNCY ahead of key near-term stock move catalysts, with topline OLC 16-week Ph2 CKD dialysis tolerance data in late 2Q24, NDA filing in mid-2024 and possible approval in mid-2024. 2025 .”

Therefore, Rahimi rates UNCY as Overweight (i.e. Buy), while her $9 price target indicates room for potential one-year upside of as much as 791%. (To view Rahimi's track record, click here)

Overall, UNCY stock has a Strong Buy rating by analyst consensus, based on four unanimously positive reviews. With an average price target of $5.88, shares could rise 482% from current levels. (To see UNCY stock forecast)

Taysha gene therapies (TSHA)

Next up is Taysha Gene Therapies, a biotech company focused on developing adeno-associated virus (AAV)-based gene therapies for serious monogenic diseases of the central nervous system. The company wants to create an adeno-associated virus delivery system, which can insert a spliced gene into a damaged genome. It is designed for single dosing, to deliver a corrected copy of the MECP2 gene to the cells of the central nervous system, addressing the genetic cause of the disease.

Specifically, the company is working on a gene therapy to tackle Rett syndrome, a serious developmental disorder of the brain. Rett patients typically develop the disease in their first year and gradually lose the motor skills — such as crawling or standing — they previously had. Over time, the disease continues to affect motor function and communication. Rett syndrome is more common in women than men and there are no effective therapies for it.

Taysha's lead asset is TSHA-102, a self-complementary, intrathecally administered AAV9 gene transfer therapy specific to Rett. The drug therapy is designed for single dosing, to deliver a corrected copy of the MECP2 gene to the cells of the central nervous system, thus addressing the genetic cause of the disease. The drug candidate is currently undergoing two Phase 1/2 clinical trials: the REVEAL trial in adolescents and adults in the US and Canada, and the REVEAL trial in children in the US and UK. Early data from both studies, based on two patients, showed a well-tolerated safety profile for the drug candidate, and the absence of side effects related to the therapy. Based on these results, the company plans to extend the studies to a second cohort at a higher dose.

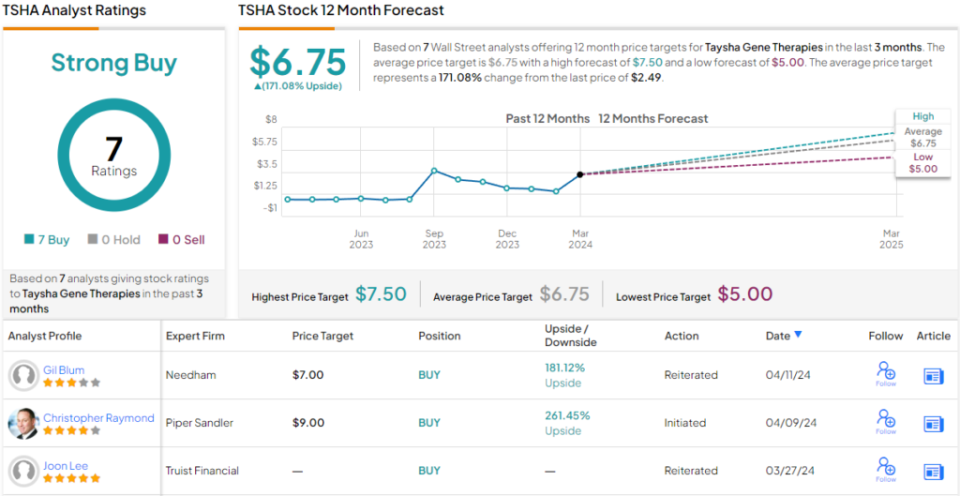

For analyst Christopher Raymond, who covers this stock for Piper Sandler, this leading drug candidate provides plenty of reason for optimism.

“We believe this company's key asset – TSHA-102 – is poised to transform the treatment paradigm for Rett syndrome – a rare, genetic neurodevelopmental disorder with a high unmet need, despite the existence of an approved therapy. With what we see as a meaningful unwinding of clinical data in hand, and further unwinding of risk data expected in the near term, we think stocks will move significantly higher as early as mid-2024, with additional factors against the end of the year,” Raymond said.

“In short, TSHA-102 represents what we see as a revenue opportunity of more than $900 million. With TSHA's current market cap of $500 million, we think the stock is only just beginning to reflect this potential. We would be buyers in light of this year's value changes,” Raymond summarized.

This all adds up to an Overweight (i.e. Buy) rating from the analyst, and a $9 price target, which implies a ~261% upside in the one-year horizon. (To view Raymond's track record, click here)

What does the rest of the Street have to say? 7 Buys and no Holds or Sells add up to a Strong Buy consensus rating. The shares are trading for $2.49, and their average price target of $6.75 suggests the stock could have a gain of 171% by this time next year. (To see TSHA stock forecast)

To find good ideas for trading penny stocks at attractive valuations, visit TipRanks' Best stocks to buya tool that unites all of TipRanks' stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.