Famed investor Warren Buffett has joked that his favorite investment period is forever. However, not all shares have the characteristics of a forever holding. Many companies do not have the sustainable business models and financial profiles needed to continue making money during periods of severe market turmoil.

Black Hills Corporation (NYSE: BKH), Enbridge (NYSE: ENB)And American States Water (NYSE: AWR), on the other hand, some Fool.com contributors stand out for their ability to continue to thrive during difficult times. They have shown this by continuing to increase their dividends over the past decades. With more growth to come, they're great dividend stocks to buy and hold for what could be a lifetime of income.

Black Hills: Rising interest rates have created a Dividend King bargain

Ruben Gregg Brouwer (Black Hills Corporation): When it comes to utilities, Black Hills is a small fry, with a market cap of roughly $3.6 billion. That said, it is a giant when it comes to dividends, as it has achieved Dividend King status with 54 years of annual dividend increases under its belt. The dividend yield of 4.8%, meanwhile, is near a decade high and well above the utility average of around 3.3%. Vanguard Utilities ETF as a proxy.

The reason for the relatively high return is largely rising interest rates, which will increase costs for Black Hills. The company has more influence than some of the biggest players in the industry. That's not exactly a new trend, so this isn't a situation where investment-grade Black Hills has somehow run into trouble. Still, management has been working to reduce debt levels and there is likely to be some pressure on earnings in the near term.

However, if you can get past the short-term headwinds, there is significant long-term promise in the fact that Black Hills' customer growth rate is nearly three times the US population growth rate. That means regulators will be incentivized to make attractive rate and investment decisions to ensure Black Hills customers have reliable access to power.

If you act now, you can buy a Dividend King with a boring, reliable company while it has historically high returns. And, just as importantly, the opportunities for business growth will continue to exist here even if the market collapses, because power is the lifeblood of modern society.

Built for whatever the future brings

Matt DiLallo (Enbridge): Enbridge is one of the most reliable companies in the energy industry. The Canadian pipeline and utility company has met its annual financial guidance for 18 years in a row. It has achieved its goals amid a financial crisis, the collapse of commodity prices and a global pandemic.

The company's low-risk cash flow profile is a key driver of its consistency. Enbridge derives 98% of its revenue from stable service fees or contracted assets. The company has been steadily working to improve the stability of its cash flow by investing in assets that generate low-risk cash flow. For example, the company is in the process of purchasing three natural gas companies Dominion to further improve the sustainability of its cash flow.

Enbridge has also been working hard to increase the long-term sustainability of its cash flows by steadily shifting its profit mix from oil to low-carbon energy, i.e. natural gas and renewables. It expects low-carbon energy to generate about half of its revenue this year, thanks to acquisitions of gas companies and investments in gas pipelines and renewable energy. This steady shift should continue into the future, driven by Enbridge's massive and growing backlog of primarily low-carbon infrastructure projects.

These projects offer Enbridge very visible grow. It expects cash flow per share to grow about 3% annually through 2026, before accelerating to 5% per year in the medium term, as some modest near-term tax headwinds fade. That should give the company the fuel to keep increasing its dividend, continuing a tradition it has maintained for 29 years straight away year.

Enbridge currently offers a dividend yield of 7.5%, giving investors a strong base return. If we take into account earnings growth, Enbridge could continue to deliver total shareholder returns in the low double digits. The company's low risk profile and solid total return potential make it an ideal stock to buy and hold for the very long term.

A no-brainer dividend growth stock to own

Neha Chamaria (American States Water): American States Water is perhaps the best example of a forever dividend stock. The Water Stock is a Dividend King, meaning it has consistently increased its dividends for at least 50 consecutive years. However, American States Water also boasts the longest dividend growth among the 55 Dividend Kings, having increased its dividend payout for 69 years in a row.

Furthermore, if you think a boring water company's dividend growth is unlikely to be impressive, consider that American States Water's quarterly dividend has grown at a solid compound annual growth rate (CAGR) of 9.4% over the past five years. The company is targeting a dividend CAGR of at least 7% in the long term.

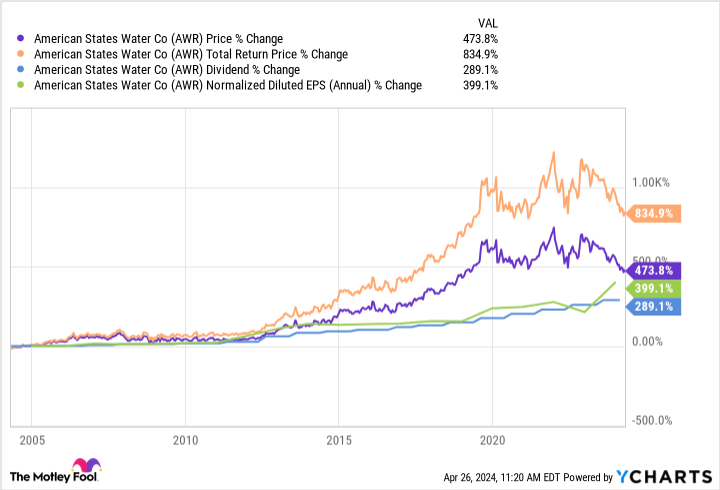

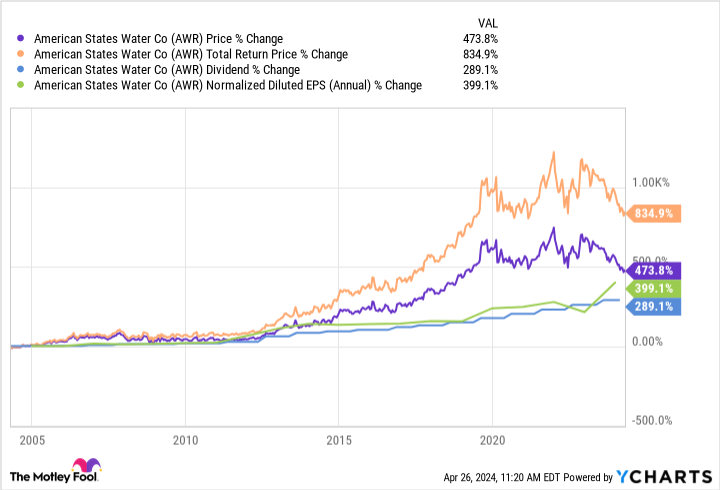

So what makes American States Water such a reliable dividend stock? As a utility that provides an essential commodity like water, the company's cash flows are regulated and therefore as stable as can be. American States Water is one of the largest water utilities in the U.S., serving more than 1 million people in nine states. At the same time, the company also provides contracted water services to military bases under 50-year contracts. Over the years, American States Water's earnings per share have grown steadily, and so have its dividends. This chart shows earnings and dividend growth over the past twenty years, as well as the stock's total return over the period. As it turns out, dividends have played a major role in determining stock returns over time.

American States Water stock may be a low-yield stock (currently yielding 2.5%), but the preceding chart shows how rewarding even a boring, low-yield dividend stock can be if it grows over the course of the can pay and grow dividends consistently over time. So if you're looking for a dividend stock that won't let you down even if the market crashes, American States Water is a good choice.

Should you invest $1,000 in Enbridge now?

Consider the following before purchasing shares in Enbridge:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Enbridge wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

Matt DiLallo has positions in Enbridge. Neha Chamaria has no position in any of the stocks mentioned. Ruben Gregg Brouwer has positions in Black Hills, Dominion Energy and Enbridge. The Motley Fool holds and recommends positions in Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has one disclosure policy.

These three dividend payers are forever stocks, even if the market crashes was originally published by The Motley Fool