Shares of less-than-truckload carriers were priced based on beat-and-raise results ahead of earnings season. Saia missed first-quarter expectations on Friday, sending its stock 20% lower and dragging the rest of its peer group lower for the second time in a week.

Saia (NASDAQ: SAIA) said March did not deliver the seasonal uptick in demand the company normally experiences. The update followed a in-line report from Old Dominion Freight Line (NASDAQ: ODFL) on Wednesday, accelerating a sell-off that began earlier this month as the broader market began moving lower and some analysts called in numbers heading into quarterly results.

In less than three weeks, Saia shares have fallen more than 25%.

The relative volume weakness in March did not undermine the company's robust growth plans.

Saia plans to open 15 to 20 new terminals in 2024 and move some operations to larger facilities or better locations. So far this year, four terminals have been opened and four terminals have been relocated. The majority of the remaining locations will open in the third quarter, with a concentration in the Great Plains.

The company has acquired 28 terminals (11 of which were leased) from the bankrupt estate of Yellow Corp. (OTC: YELLQ). Starting with an expansion project in the Northeast in 2017, the company has opened 50 locations. The company will spend about $550 million on real estate this year, increasing its door count by about 12% to 14%. It will also spend a total of $400 million on equipment to meet its growth targets.

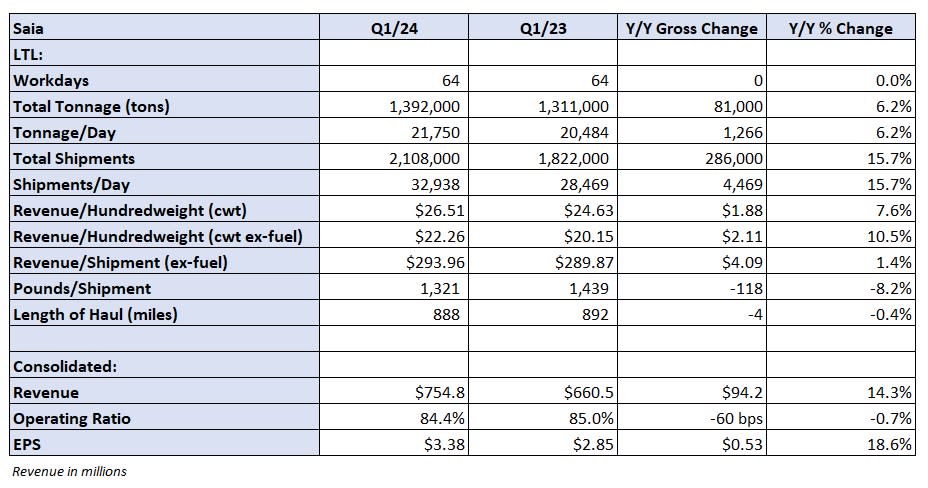

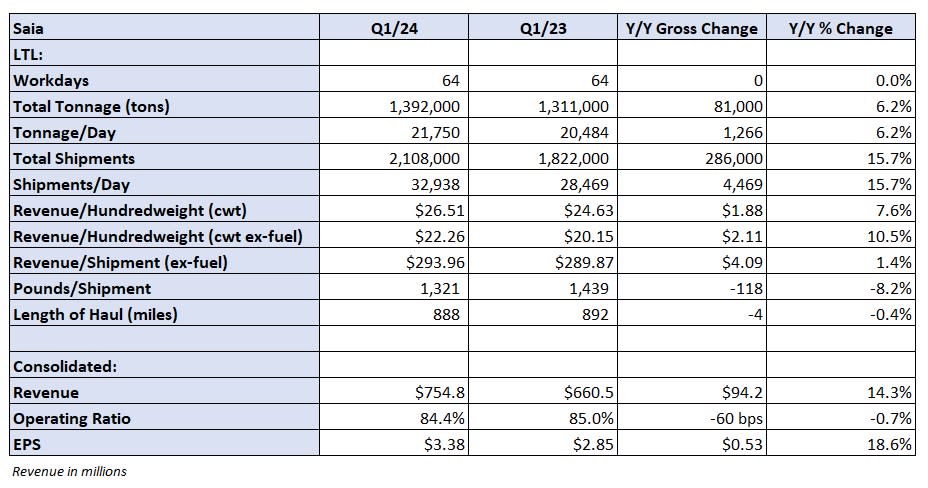

Saia reported first-quarter earnings per share of $3.38, 7 cents below the consensus estimate but 53 cents higher year-over-year (y/y).

Revenue rose 14% year over year to $755 million, while tonnage per day increased 6% and revenue per hundredweight, or yield, increased 8% (11% higher excluding fuel surcharges). The tonnage increase was the combination of a 16% increase in the number of shipments, partially offset by an 8% decrease in weight per shipment.

The decrease in shipment weight led to an increase in the yield metric.

Compared to the fourth quarter, tonnage per day decreased by 1%, as did revenue excluding fuel surcharges.

Shipments per day rose 16.8% year over year in March, but was not in line with management expectations. So far in April, shipments are up 17% year over year, while tonnage is up 6.5%. The company said April metrics benefit by one to two percentage points as Good Friday fell in March this year compared to April last year.

“We are focused on generating value for our customers and generating returns for our shareholders,” Fritz Holzgrefe, president and CEO of Saia, said on a Friday call with analysts. “We do not remain fixated on volume figures. We remain focused on meeting the first two expectations.”

Saia's daily shipments have increased 16% to 33,000 over the past year. The carrier has been one of the most active stocks since then Geel's closure last summer.

Sales per shipment increased by only 1.4% year-on-year, excluding fuel, and decreased by 0.4% compared to the fourth quarter. That, too, raised concerns among analysts, who based their optimistic outlook for the space on carriers' idiosyncratic ability to meaningfully price freight rates above cost inflation.

Management countered that there has been no change in pricing philosophy and that the company has taken on more shipments from large, national accounts, which sometimes have smaller margins. The decrease in weight per shipment and a 0.4% decrease in transport time also weighed on the figures.

“If I get some cuts on the cost side, so if I go to deal with one of the bigger bills, I'll get five or six instead of getting two or three bills. … I'm getting really good cost savings there,” said CFO Doug Col.

The decline in costs per shipment in the quarter was greater than the decline in revenue per shipment by 80 basis points.

“If you give us a stronger macroeconomic backdrop, I would still say… you'll see another increase in this pricing. It doesn't get cheaper to do what we all do,” Col added.

The number of contractual renewals increased by an average of 9.2% in the period, 50 basis points higher than the average increase in the fourth quarter.

Management expects second quarter revenue to increase by a mid-single digit percentage compared to the first quarter. That roughly implies a 15% increase year-over-year, which would be about $35 million compared to the current consensus estimate of $829 million.

The company reported an operating ratio of 84.4%, which was 60 basis points better year-over-year and sequentially. The result was in line with the normal sequential improvement of 50 to 75 basis points, even in worse than normal weather in January.

Spending on salaries, wages and benefits (as a percentage of turnover) remained stable year-on-year, even with a 15% increase in headcount and the implementation of a 4.1% wage increase in July last year. Depreciation costs (as a percentage of sales) also remained stable year-on-year, despite recent growth-oriented investments.

Saia typically sees an OR improvement of 250 to 300 basis points between the first and second quarters. This year, however, the company forecasts an improvement of only 150 to 200 basis points, given the costs associated with opening new terminals. The company reiterated its forecast for an OR improvement of 100 to 150 basis points for full-year 2024.

Saia also announced on Friday that Col will retire after ten years with the company. He will remain in this role for the remainder of the year to ensure a smooth transition.

Shares of SAIA fell 21.3% as of 12:06 a.m. EDT on Friday compared to the S&P 500, which rose 1%. XPO (NYSE: XPO) fell 10.2%, ArcBest (NASDAQ: ARCB) fell 6.8% and ODFL fell 6%.

More FreightWaves articles from Todd Maiden

The mail Saia's first-quarter miss, weak March deliveries send shares 20% lower appeared first on Freight waves.