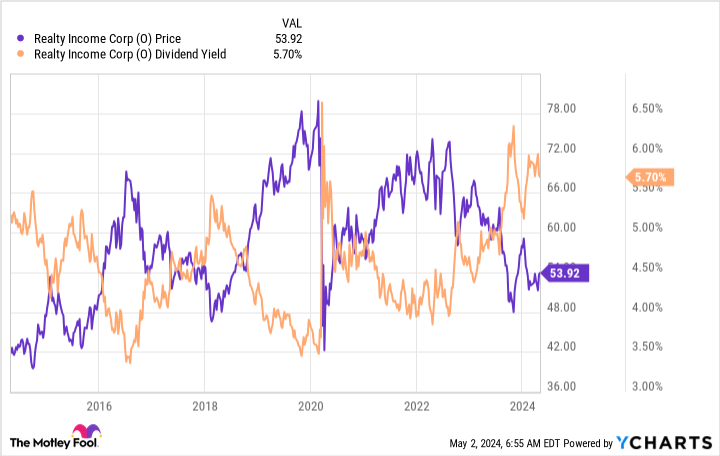

Shares of Real estate income (NYSE:O) Trading is down about 33% from its pre-pandemic high in early 2020. But nothing substantive has changed about the business, or at least not in a permanently negative way. If you're looking for a reliable dividend stock, there's still time to grab Realty Income and its historically attractive 5.7% yield. Here's why you need to do it now and not risk being late to the party.

Realty Income is the market leader

Real estate income is a real estate investment fund (REIT) that purchases single-tenant properties for which the tenants are responsible for most of the expenses at the property level. This is a so-called net lease. Each individual property carries a high risk as there is only one tenant, but spread across a large portfolio the risk is quite low as the normal running costs of the property are largely passed on to the tenant. Realty Income owns a whopping 15,450 properties.

Realty Income is by far the largest publicly traded net lease REIT. In fact, it's $46 billion Market capitalization is about four times larger than its closest cousin. And Realty Income has proven to be a very reliable dividend stock, having increased its dividend annually for 29 consecutive years. The adjusted payout ratio (FFO) in 2023 was a very reasonable 75% or so. While that may seem high, keep in mind that Realty Income doesn't have to pay most expenses at the property level, freeing up more money to pay dividends.

Meanwhile, the aforementioned decline in stock prices has pushed returns to their highest levels in the past decade. So the stock also looks relatively cheap at the moment.

What's wrong with Realty Income and what about the future?

But why is real estate income cheap? The quick answer is interest rates, but the most important thing investors need to understand is that nothing has changed at the company. It is still a large and conservatively managed net lease REIT. The issue has a broader basis, as higher interest rates simply make it more expensive for REITs to run their business. Debt plays an important role in the purchase of real estate and it takes time for the real estate markets to adapt to the changed interest rate environment.

Over time, however, sellers will have to adjust their asking prices lower, improving returns for buyers when they want to sell their properties. When that happens, REITs will see their financial performance improve overall. Prices are sticky simply because sellers don't want to lower prices unless they really need to, which sometimes takes some pain (such as when the seller is faced with an expiring debt obligation).

That said, Realty Income's size offers significant advantages over smaller competitors. First, it is so large that it usually has easier access to capital markets. Second, it is conservative and thus has an investment grade credit rating. Combine the two, and the REIT can usually obtain relatively cheap capital to finance its acquisitions in any market environment. It's also big enough to take on deals that its peers can't, including being an industry consolidator (it recently bought a smaller competitor). And the company's portfolio includes European assets, allowing it to invest in two broad regions, significantly increasing its opportunities.

Real Estate Income: For those who like to own the biggest and best

Frankly, Realty Income will likely face tough market conditions until rates stabilize or, better yet, decline. So you didn't miss this and you probably have some time to do a deep dive without risking missing the opportunity here. But if you dawdle too long, perhaps trying to time the perfect inflection point, you risk missing the opportunity to buy this reliable, but boring, industry-leading net-lease REIT. It's probably better to be right and act sooner rather than later.

Should you invest €1,000 in real estate income now?

Consider the following before purchasing shares in Realty Income:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Realty Income wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Ruben Gregg Brouwer has positions in Realty Income. The Motley Fool holds positions in and recommends Realty Income. The Motley Fool has one disclosure policy.

Is it too late to buy real estate income stocks? was originally published by The Motley Fool