Coca-Cola (NYSE:KO) is one of Warren Buffett's favorite stocks, and this Dividend King has been rewarding shareholders with increasing, high-yield dividends for more than sixty years.

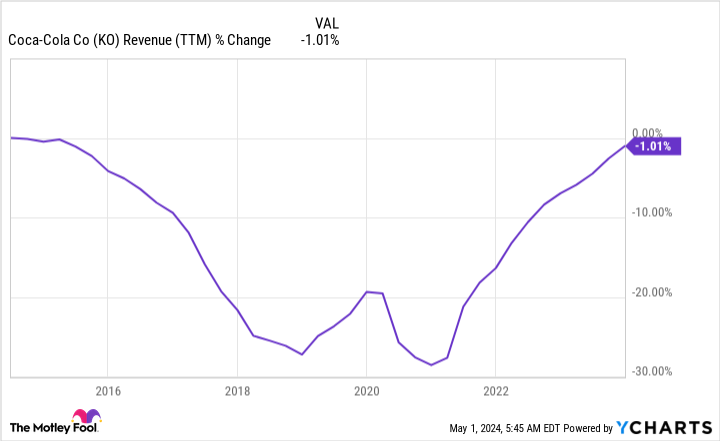

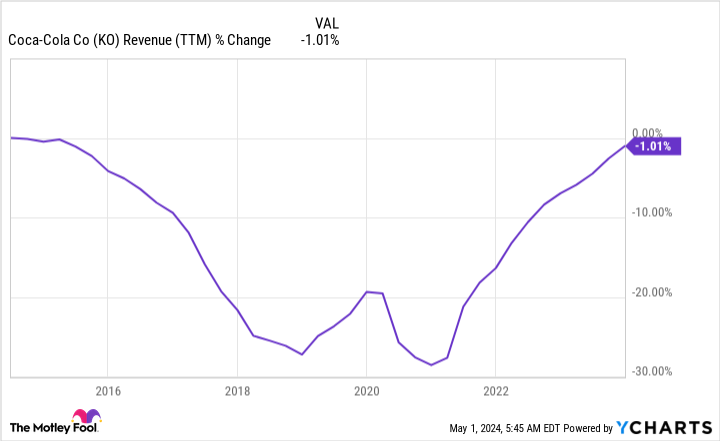

But believe it or not, the company is still in the midst of a recovery after sales fell off a cliff several years ago, and 2024 could mark the culmination of that recovery. Let's take a look at how this is likely to play out and why it's important for investors.

Coca-Cola hasn't always been a beverage superstar

Many people consider Coca-Cola to be the main beverage superstar. It is the largest beverage company in the world, with $46 billion in revenue turnover over the last twelve months, and sales have been steadily increasing since hitting lows early in the pandemic; they are up almost 37% since the worst of that time.

But the problem started much earlier. Coca-Cola became too big to control and it was a disorganized and rigid global operation. Current CEO James Quincey took the reins in 2017, when sales fell by as much as 15% that year. He set out a strategy to bring the company together, reorganize the bottling plants and create a fast and flexible distribution network.

The pandemic threw a spanner in the works for Coca-Cola, but the company was reorganized again and now works better and faster. However, turnover remains below the level of ten years ago. However, it's getting very close and will likely finally surpass that goal in the second quarter of 2024:

Coca-Cola may be better than ever

There are good reasons to believe that Coca-Cola can continue its growth trajectory under Quincey's steady leadership. One of the most important steps the company took early in the pandemic was to shrink its brand portfolio by about half, from 400 to 200 brands. That's a bold move that freed up resources to spend on its core businesses, and Coca-Cola's namesake brands remain the main draws. Management said it owns 26 different brands that each generate more than $1 billion annually, and that these core brands are key to future growth.

Yet they do not leave it at that. The brands divested were small, mostly local underperformers, responsible for approximately 2% of volume and 1% of revenue. Coca-Cola is still acquiring new brands, but is focusing on top global brands that have robust opportunities in larger markets. For example, it acquired Bodyarmor in 2021, when the brand was growing sales rapidly. Bodyarmor is now one of the company's $1 billion brands.

Acquisitions can be a key growth driver because as Coke adds new beverages to its systems, they can reach new customers with great efficiency. This can lead to a large increase in turnover, at least initially, without corresponding costs.

With this dual growth strategy of investing in its core brands and acquiring new ones to drive sales, Coca-Cola is well positioned to effectively utilize its distribution network and generate higher sales and profits. It's reaching the top of its previous record sales figures and should easily go higher.

Is Now the Time to Buy Coca-Cola Stock?

Coca-Cola has been a reliable dividend superstar for decades, but its stock price hasn't been all that impressive as it has lagged the broader market over the past three decades. That doesn't make it a loser; on the contrary, most individual stock portfolios benefit from having a number of stable, high-quality and dividend stocks anchoring their holdings.

Coca-Cola stock offers stability, value, and reliable passive income. And since it's about to set a record for annual revenue this year, now's a good time to buy the stock.

Should You Invest $1,000 in Coca-Cola Now?

Before you buy Coca-Cola stock, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Coca-Cola wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has one disclosure policy.

Coca-Cola is about to do something it hasn't done in a decade was originally published by The Motley Fool