Nvidia has been an ideal long-term investment. The shares soared 45,900% in the last 20 years as the company transitioned from a computer graphics pioneer to an accelerated computing powerhouse. But the shares have been particularly popular lately. Shares have more than tripled in the past 12 months as investors banked on the artificial intelligence gold rush. But those gains have raised concerns about Nvidia's valuation.

While some Wall Street analysts still see upside, some expect the stock to fall in the coming year. The four hedge fund billionaires mentioned below managed to avoid this situation by selling some Nvidia shares in the fourth quarter, while simultaneously buying shares of the company. Invesco QQQ Trust (NASDAQ: QQQ)an index fund that represents the Nasdaq-100.

-

John Overdeck and David Siegel of Two Sigma Investments sold 30,663 shares of Nvidia in the fourth quarter, reducing their stake by 5%. Meanwhile, they increased their position in the Invesco QQQ Trust by 75%, so that the index fund is now the second largest position in their portfolio.

-

Israel Englander of Millennium Management sold 1.7 million shares of Nvidia in the fourth quarter, reducing his stake by 45%. Meanwhile, he increased his position in the Invesco QQQ Trust by 53%, although this remains a relatively small holding.

-

Bamco's Ron Baron sold 59,942 shares of Nvidia in the fourth quarter, reducing his stake by 10%. He also started a small position in the Invesco QQQ Trust.

What makes these trades interesting is that Nvidia is the third largest position in the Invesco QQQ Trust. In other words, the four fund managers mentioned above have traded some of their direct ownership in Nvidia for a more diluted form of ownership, which also provides exposure to other technology stocks.

Be that as it may, the Invesco QQQ Trust has returned 1,260% over the past twenty years, more than doubling the company's performance. S&P500 (SNPINDEX: ^GSPC). Here's what investors need to know about that supercharged index fund.

The Invesco QQQ Trust provides exposure to technology stocks that should benefit from artificial intelligence

The Invesco QQQ Trust measures the performance of the Nasdaq-100, an index that tracks the 100 largest companies listed on the Nasdaq Stock Exchange. The Invesco QQQ Trust distributes capital across 10 of the 11 stock market sectors – financials is the only exclusion – but its composition is most heavily weighted in the information technology (58.9%) and consumer discretionary (17.9%) sectors.

The top 10 holdings in the Invesco QQQ Trust are listed below by weight.

-

Microsoft: 8.7%

-

Apple: 7.7%

-

Nvidia: 6.1%

-

Alphabet: 5.3%

-

Amazon: 5.3%

-

Broadcom: 4.5%

-

Metaplatforms: 4.5%

-

Costco Wholesale: 2.4%

-

Tesla: 2.4%

-

Advanced micro devices: 1.9%

While many investors consider Nvidia to be the ultimate artificial intelligence (AI) stock, virtually every company listed above is well positioned to make money from AI.

For example, Microsoft, Alphabet and Amazon are the three largest cloud computing companies in the world, meaning they are gatekeepers of AI infrastructure and platform services. Broadcom is a leader in application-specific integrated circuits (ASICs), meaning it helps companies like Meta Platforms and Alphabet design custom AI chips.

Similarly, Tesla is designing full self-driving software and its supercomputer (Dojo) is built specifically for training computer vision systems; both represent potentially significant revenue streams. Finally, Advanced Micro Devices is the second-largest supplier of data center GPUs, although it trails Nvidia in market share by about 90 percentage points.

In short, while the Invesco QQQ Trust is not explicitly an AI index fund, it offers easy exposure to many companies that should benefit as companies spend more money on AI.

The Invesco QQQ Trust has delivered astonishing returns over the past twenty years

The Invesco QQQ Trust has been an excellent, but volatile, long-term investment. The index fund has achieved a return of 1,260% over the past twenty years, which equates to an annual return of 13.9%. By comparison, the S&P 500 returned 563% over the same period, for an annual return of 9.9%. In other words, the $10,000 invested in the Invesco QQQ Trust in April 2004 would be worth $136,000 today, but the same amount invested in an S&P 500 index fund would now be worth $66,300.

However, that enormous outperformance comes at a price. The Invesco QQQ Trust has a 10-year beta of 1.12, meaning the index has risen 112 basis points (1.12 percentage points) for every 100 basis point move in the S&P 500. In other words, the Invesco QQQ Trust has been a very volatile business. investment. That quality cuts both ways. Volatility is helpful when the stock market goes higher, but harmful when the stock market goes lower. As a result, the Invesco QQQ Trust tends to underperform during market downturns.

The last point to consider is the expense ratio. The Invesco QQQ Trust has an expense ratio of 0.2%, meaning investors will pay $2 per year for every $1,000 invested in the fund.

Here's the end result: The Invesco QQQ Trust is heavily weighted towards the technology sector. As such, the index fund has benefited enormously from disruptive innovations such as mobile devices and cloud computing over the past two decades, and should benefit greatly as AI spending explodes in the coming years. In that sense, the Invesco QQQ Trust is a great option for patient, risk-tolerant investors looking to benefit from the AI boom. But it would be a bad choice for any investor looking to avoid volatility.

Should you invest $1,000 in Invesco QQQ Trust now?

Consider the following before purchasing shares in Invesco QQQ Trust:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

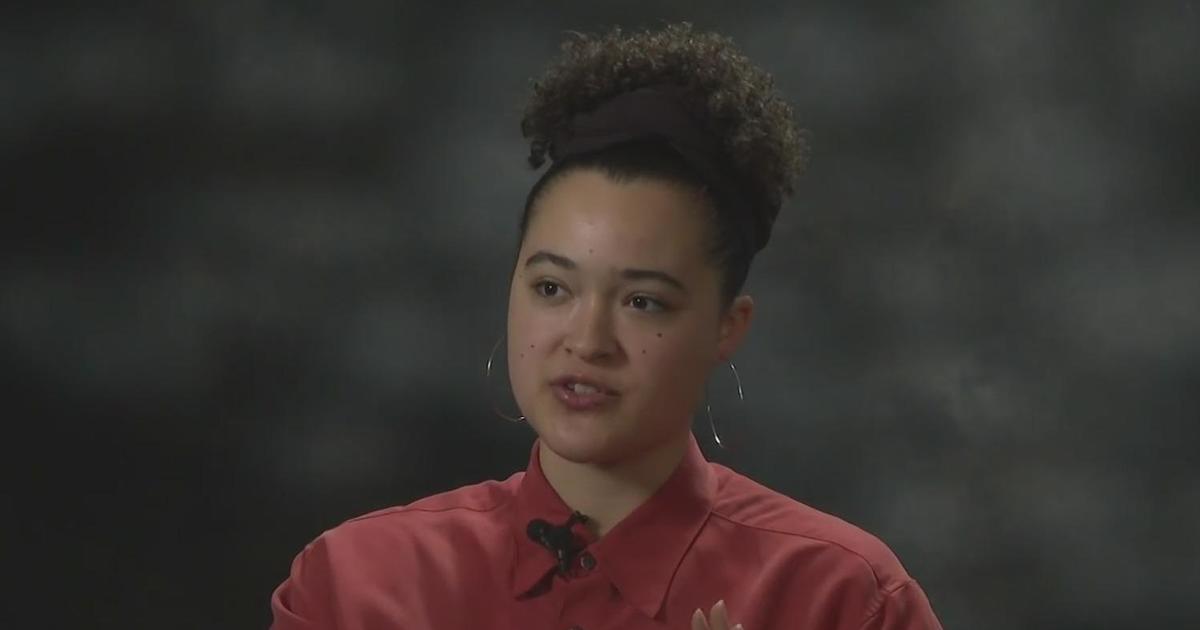

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool's board of directors. Trevor Jennevine has positions in Amazon, Nvidia and Tesla. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has one disclosure policy.

Billionaires are selling Nvidia stock and buying this Supercharged AI Index Fund instead was originally published by The Motley Fool