Alibaba Group (NYSE: BABA) has had a tough time lately, with the stock down nearly 60% over the past five years. However, billionaire co-founder Jack Ma recently praised the company and its restructuring efforts. Ma said that while mistakes have been made in the past, the decision to split the company into six divisions has made it more agile and customer-focused.

Let's take a look at Alibaba's prospects and whether the stock is currently a buy, sell, or hold.

A free cash flow machine

Despite the problems, the one thing Alibaba has been able to do consistently is produce a huge amount cash flow. For the fiscal third quarter ended in December, it generated operating cash flow of $9.1 billion and free cash flow of $8 billion. Through the first nine months of the year, the company generated $22.4 billion in operating cash flow.

Strong cash flow is important because it gives companies a lot of flexibility. They can reinvest it to revive the company's growth, or use it to make acquisitions. The money can also be used for this buy back shares.

Alibaba has been aggressive in its share buybacks, announcing a $25 billion share buyback program in February. The company acted quickly on the buyback authorization, buying back $4.8 billion worth of shares in the first three months of 2024. Alibaba has now repurchased $23.3 billion worth of shares over the past two years.

Alibaba also wants to invest in its two core businesses, e-commerce and cloud computing, to revive growth. For its e-commerce activities, Alibaba wants to invest in price competitiveness, service and user experience. Improving the product offering and adding more branded and direct-from-manufacturer products will be a key initiative, which will also include offering flexible models to suppliers so they can offer their products at the best prices.

The company also invests in the customer experience, from pre-sales to logistics. Additionally, Alibaba is in the early stages of testing its own internally developed large language model (LLM) for artificial intelligence (AI) to help improve its search and advertising capabilities.

For its cloud computing business, Alibaba wants to move customers away from low-margin project-based contracts and toward its public cloud offerings. The company is increasing investments in AI-related hardware and software and expanding infrastructure to support demand for AI-powered computing power.

There are still some risks ahead

Chinese companies are more limited with AI, given the US ban on the latest GPU technology Nvidia and others, so Alibaba may not see the same immediate benefit that U.S. cloud computing companies like Microsoft And Alphabet To see. At the same time, Alibaba cut cloud computing prices to attract AI developers to its data center offerings. So while AI has long-term potential, it could create some short-term headwinds.

Alibaba's e-commerce business, meanwhile, has also had to invest in price, given the strength of its competitors PDD companies and the popular Pinduoduo platform that is rapidly gaining market share. PDD's success has made China's e-commerce market even more competitive, although Alibaba's T-Mall and Taobao platforms are still two of the strongest e-commerce sites in the country and tend to do well at the high end .

A lackluster Chinese economy emerging from pandemic lockdowns has also weighed on Alibaba's results. The Chinese economy did pick up in the first quarter and the Chinese government has indicated that it will take measures to support the economy. Any recovery in the Chinese economy should be good for Alibaba, although risks remain.

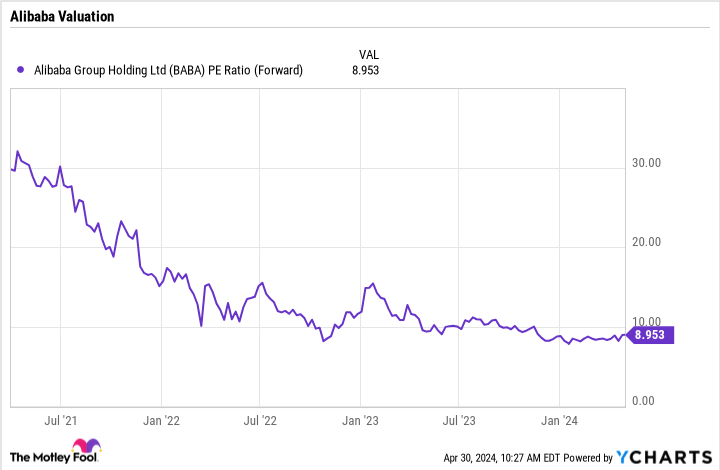

A very cheap share

One of the big things that stands out about Alibaba is its valuation. The stock trades at a price-to-earnings ratio of around 9x and is very cheap for a company that has grown its revenue 9% over the past nine months and is generating a lot of cash flow.

Now a cheap valuation isn't enough reason to buy a stock because it could be a value trap. However, Alibaba is a cheap stock of a leading Chinese company that generates a large amount of cash that it uses to buy back shares and invest in its operations to reignite growth. While the stock comes with risks, its upside potential over the next few years seems intriguing given these characteristics. As such, Alibaba stock is a buy right now.

Should You Invest $1,000 in Alibaba Group Now?

Consider the following before buying shares in Alibaba Group:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alibaba Group wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool's board of directors. Geoffrey Seiler has positions in Alibaba Group and Alphabet. The Motley Fool holds positions in and recommends Alphabet, Microsoft and Nvidia. The Motley Fool recommends Alibaba Group and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has one disclosure policy.

Alibaba Stocks: Buy, Sell or Hold? was originally published by The Motley Fool