Regarding the quarterly results, Amazon (NASDAQ: AMZN) shareholders have nothing to complain about at this point. The e-commerce giant's first-quarter revenue of $143.3 billion and earnings per share of $0.98 both exceeded expectations and were well above year-ago levels. Shares of Amazon moved higher after the release of the company's first-quarter report Tuesday evening. Get another win for all the obvious reasons.

However, there are some less obvious reasons to buy Amazon stock that further strengthen the already positive situation.

1. Amazon Web Services becomes much more cost-efficient

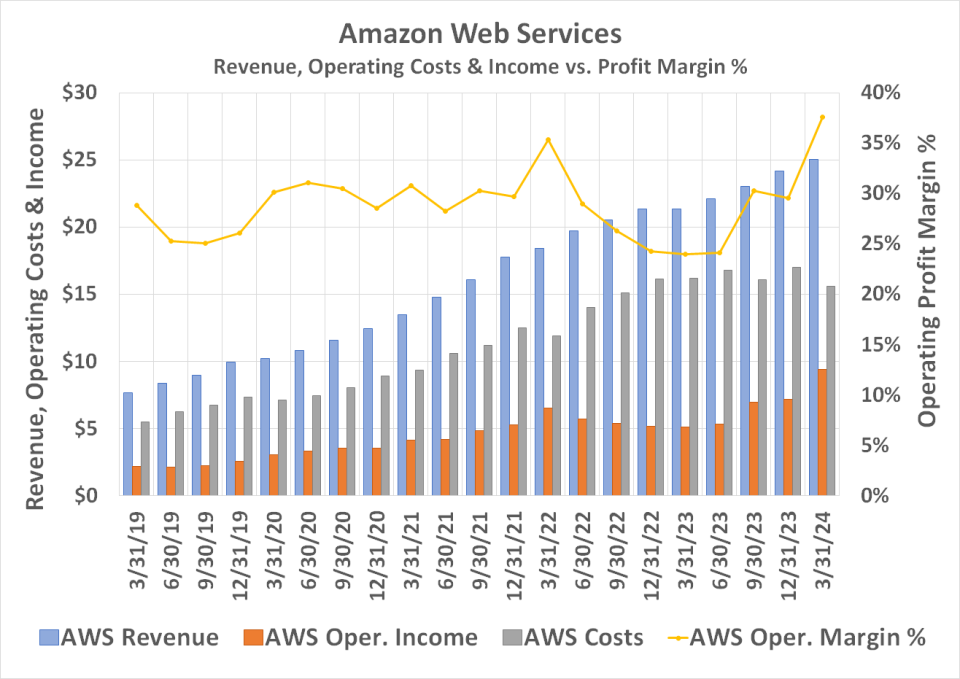

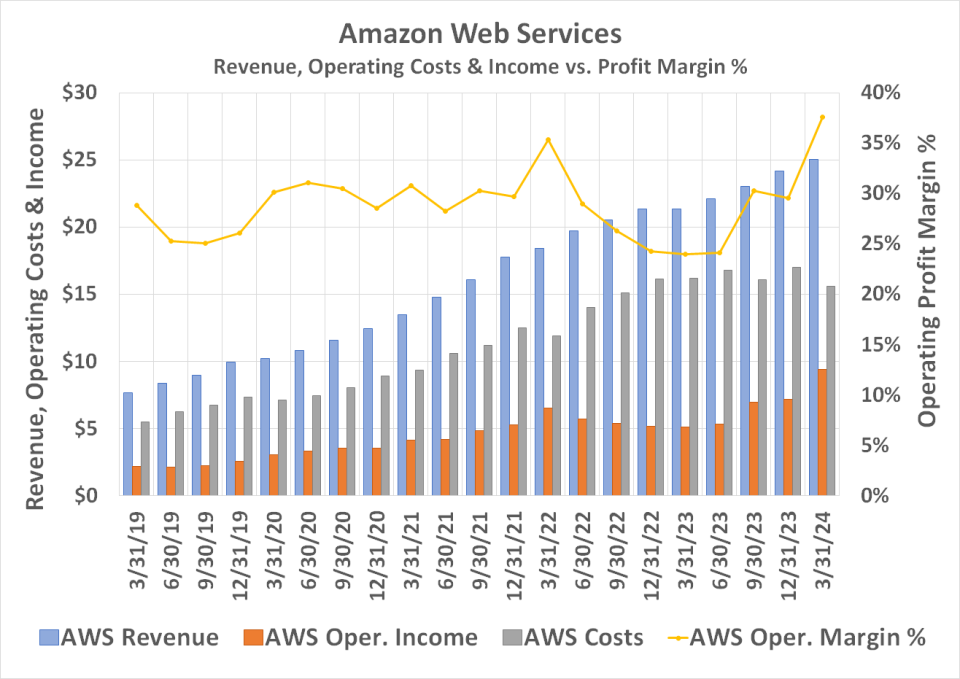

Perhaps one of Amazon's most exciting growth engines right now is its own growth engine cloud computing arm. Amazon Web Services (or AWS) has been growing at double digit rates for several years. However, this company hit an alarming wall as of mid-2022, thanks to the high costs of operating a cloud computing division in an inflationary environment. AWS's bottom line and operating margins have been weak since 2022, even as cloud revenues have continued to grow.

However, all this seems to have changed dramatically over the past quarter. After the slight turnaround that started to take shape in the third quarter of last year, AWS's operating margin rose to a record-breaking 37.6% in the first quarter of this year.

Intentional cost control certainly helped. There is also the benefit of inflation at least starting to level off. Then there is the economy of scale. That is, the larger this company becomes, the more cost-efficiently it can be managed.

Whatever the reason(s), considering that Amazon Web Services accounts for nearly two-thirds of Amazon's operating revenue, these increasing profit margins are a pretty big – and encouraging – deal.

2. E-commerce is (finally) a business worth running

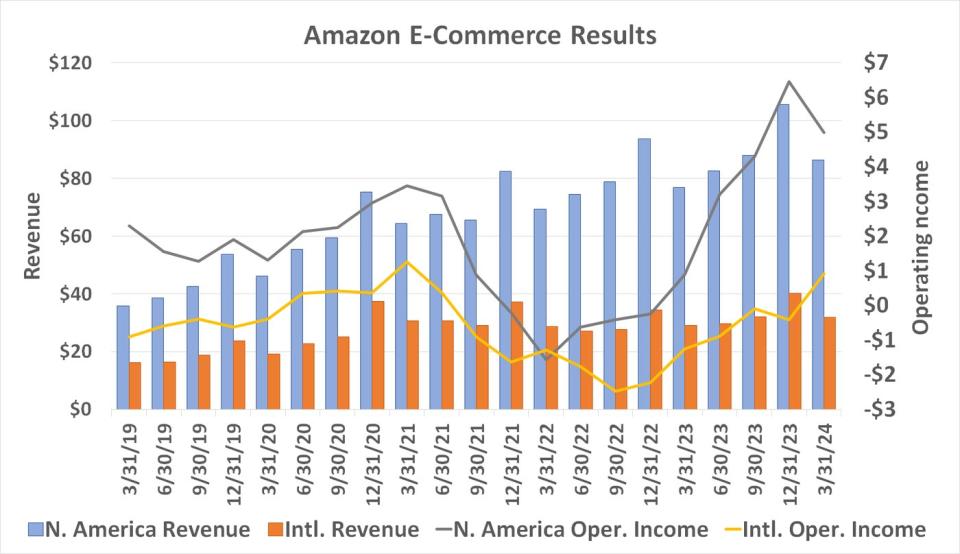

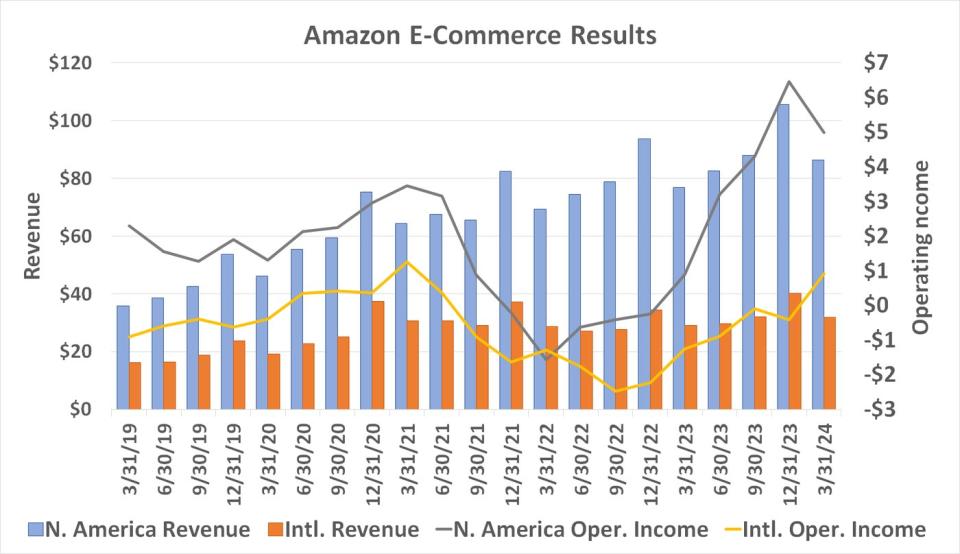

It's curious. In Amazon's infancy, it was much more concerned with expanding its reach than making profits. And investors liked the idea. However, the company never seemed interested in increasing earnings growth, even when it arguably could have. Shareholders became so used to the tight profit margins that they never really put pressure on it.

Well, lo and behold (and without much fanfare), Amazon's e-commerce business is finally making surprisingly big profits. After record-breaking fourth quarter operating income, first quarter e-commerce operating income of $5.9 billion is another record-breaker for the calendar quarter in question. That's impressive, considering that inflation has been a problem for both businesses and consumers.

Perhaps the most compelling data in the chart above, however, is that Amazon's international e-commerce business is returning to profitability, even though the business has seen minimal sales growth since the pandemic-induced surge. This will help justify the company's continued investment in its overseas operations, where the majority of its future growth will lie; the North American market is quite saturated.

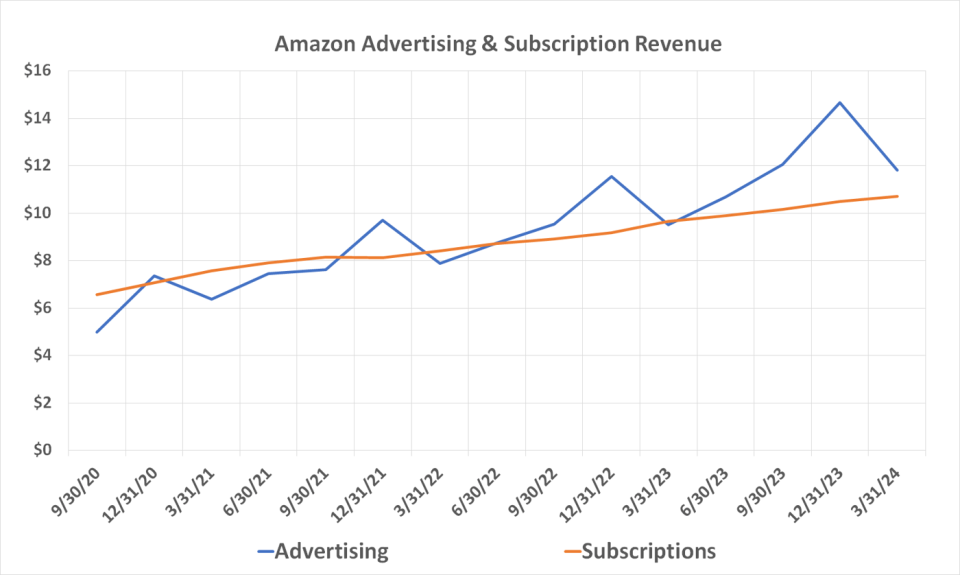

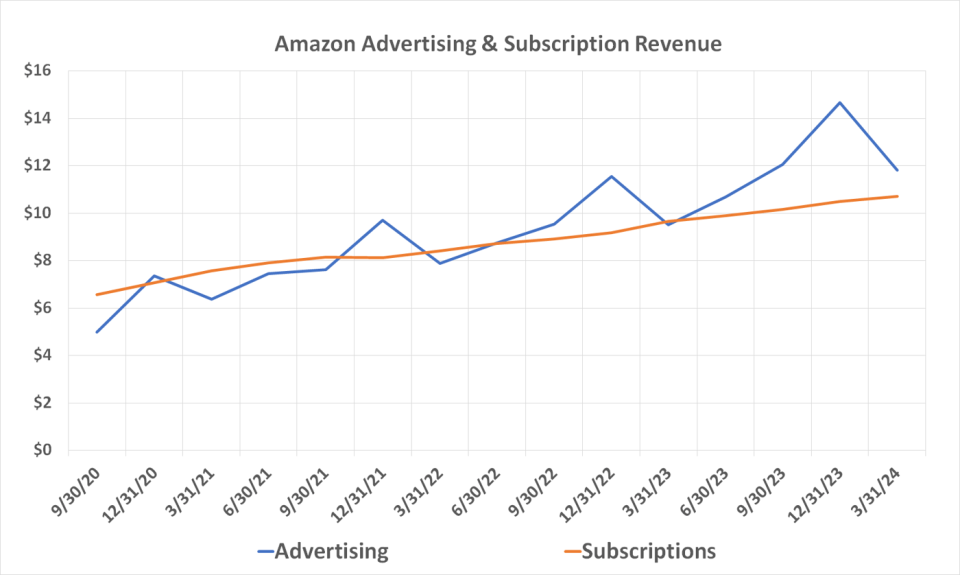

3. Advertising and subscription revenues are soaring

But why is Amazon's e-commerce business suddenly so profitable? Greater scale and improved efficiency are certainly factors. However, the company is also evolving. Amazon.com is becoming less of a purely online shopping center and more of an advertising platform.

Oh, it's almost always been one, for the record. That is, third-party sellers have long been able to pay to have their products appear more prominently on the website. But over the past few years, tensions in this industry have been heating up. Last quarter's ad revenue of $11.8 billion is 24% better than the year-ago comparison, continuing an established growth trend. This is also high margin revenue.

The other data set shown in the chart above charts the growth of Amazon's subscription business. This is primarily revenue generated by subscriptions to Amazon Prime, but can also include other subscription-based services such as digital music or grocery delivery. Last quarter's subscription revenue reached a record-breaking $10.7 billion, up 11% year over year.

This continued growth is no small feat, but not necessarily for the reason you might think. It's not so much about that income. These subscribers are known to spend more with Amazon than non-subscribers. This rising figure simply means that the company is adding more fruitful customers to its active customer base.

All of this makes Amazon stock an even better buy

Of course, these aren't the only reasons to own Amazon stock. The bigger, more obvious ones are still in place. These include the company's dominance of the e-commerce market and its continued expansion. Amazon Web Services is also an attractive business, regardless of whether profit margins improve.

Nevertheless, these details make the already solid bullish case even better. Amazon handles the big and small things well, capitalizing on its unique strengths such as its enormous size and technological capabilities. Few other companies will ever be able to match this.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has one disclosure policy.

3 Surprising Reasons Why Investors Should Buy Amazon Stock Now was originally published by The Motley Fool