Investing in the stock market can be difficult. After all, there are tens of thousands of investment options from which to choose. So, where is the best place to start?

In my opinion, exchange-traded funds (ETFs) offer something for everyone. They are a great place for new investors to start. Meanwhile, a seasoned investor can often find an ETF that will help him supplement his portfolio or increase his returns.

So let's take a look at three technology ETFs that I think are worth considering for growth-oriented investors.

Technology Select Sector SPDR Fund

First up is the Technology Select Sector SPDR Fund (NYSEMKT: XLK). This ETF is one of the largest technology sector ETFs in the world, with net assets of over $65 billion. Furthermore, with a track record dating back to the 1990s, this is one of the oldest technology ETFs out there.

Top positions include Microsoft, Apple, Nvidia, BroadcomAnd Advanced Micro Devices. However, potential investors should be aware of how top-heavy these investments are; Microsoft and Apple alone account for 42% of the fund's total investments.

|

Company Name |

Symbol |

Percentage of assets |

|---|---|---|

|

Microsoft |

MSFT |

22.9% |

|

Apple |

AAPL |

19.3% |

|

Broadcom |

AVGO |

4.5% |

|

Nvidia |

NVDA |

4.5% |

|

Advanced micro devices |

AMD |

3.1% |

|

Sales team |

CRM |

3.1% |

|

Adobe |

ADBE |

2.4% |

|

Accenture |

ACN |

2.3% |

|

Cisco systems |

CSCO |

2.1% |

|

Oracle |

ORCL |

2.1% |

In terms of performance, the fund has a astonishing 20.3% compound annual growth rate (CAGR) over the past ten years, which is well above 20.3% S&P500's 12.5% CAGR over the same period.

Moreover, the fund expense ratio of 0.09% is great. It's one of the lowest expense ratios available for a sector-focused ETF, and it means investors pay just $9 per year for every $10,000 invested in the fund.

VanEck Semiconductor ETF

Next is the VanEck Semiconductor ETF (NASDAQ: SMH). As the name suggests, this fund focuses on all facets of the semiconductor sector, including chip designers, manufacturers and foundries.

With semiconductors appearing in more places than ever—your smartphone, your car, maybe even your refrigerator—it's been a great time to own semiconductor stocks. As a result, the VanEck Semiconductor ETF boasts an incredible 27.2% CAGR dating back to 2014.

Top holdings in the fund include Nvidia, Inteland Broadcom.

|

Company Name |

Symbol |

Percentage of assets |

|---|---|---|

|

Nvidia |

NVDA |

20.6% |

|

Taiwanese semiconductor manufacturing company |

TSM |

11.9% |

|

Broadcom |

AVGO |

7.7% |

|

ASML Holding |

ASML |

4.9% |

|

Texas Instruments |

TXN |

4.6% |

|

KWALCOMM |

QCOM |

4.6% |

|

Intel |

INTC |

4.5% |

|

Lam Research |

LRCX |

4.5% |

|

Micron |

MU |

4.4% |

|

Applied materials |

AMAT |

4.4% |

Furthermore, the rapid growth of artificial intelligence (AI) applications – and the need for the fast, powerful semiconductors behind them – means the future looks bright for chipmakers.

As for costs, investors in the fund get an expense ratio of 0.35%. While that's not terrible, it's also not the lowest fee out there for technology sector ETFs. In other words, you are paying for quality when it comes to this ETF.

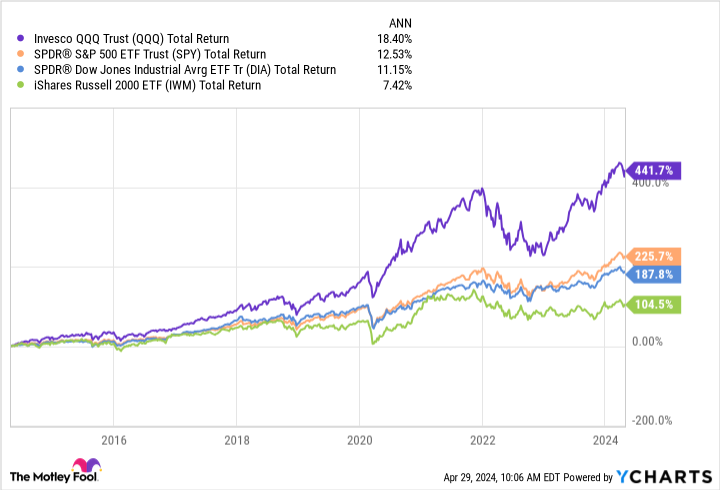

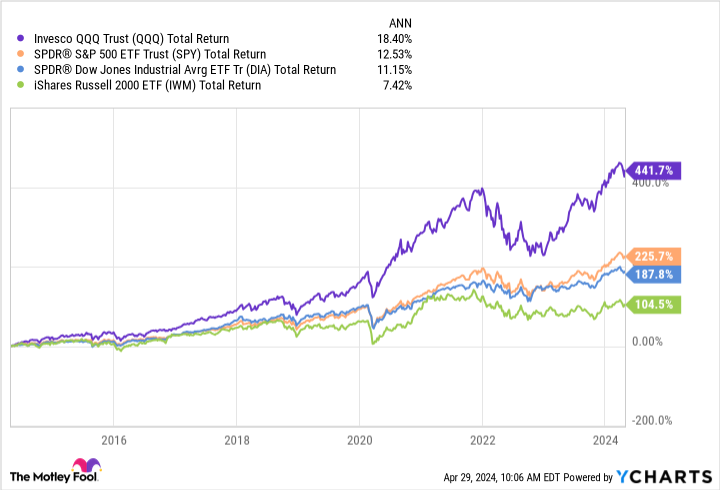

Invesco QQQ Trust

Last but not least is the Invesco QQQ Trust (NASDAQ: QQQ). Strictly speaking, this fund is not a purely technical ETF; his holdings include stocks such as Costco, PepsiCoAnd Marriot International.

However, more than 50% of its holdings are technology companies, meaning it qualifies as a technology sector ETF in my view. Plus, this fund, also known as “the QQQs,” is one of my favorite ETFs. This is why:

The reason why it is not overdiversified is that the fund follows the price Nasdaq100 Table of contents. This index consists of non-financial shares listed on the Nasdaq stock exchange, weighted by market capitalization, with some changes. In other words, it is similar to the S&P 500 index, but slightly smaller, with a higher concentration of technology stocks and no financial stocks.

The top companies include many of the Magnificent Seven:

|

Company Name |

Symbol |

Percentage of assets |

|---|---|---|

|

Microsoft |

MSFT |

8.8% |

|

Apple |

AAPL |

7.6% |

|

Nvidia |

NVDA |

5.8% |

|

Alphabet |

GOOG/GOOGL |

5.4% |

|

Amazon |

AMZN |

5.3% |

|

Metaplatforms |

META |

5% |

|

Broadcom |

AVGO |

4.4% |

|

Tesla |

TSLA |

2.4% |

|

Costco |

COST |

2.3% |

|

Advanced micro devices |

AMD |

1.8% |

In terms of performance, the fund has achieved a CAGR of 18.4% over the past ten years, which easily exceeds the returns of the S&P 500, Dow Jones Industrial Average and Russell 2000.

Finally, the expense ratio is reasonable at 0.20% – meaning investors pay $20 per year for every $10,000 invested.

In short, each of these technology-oriented ETFs offers something unique, but all are worth considering for growth-oriented investors.

Should you invest $1,000 in VanEck ETF Trust – VanEck Semiconductor ETF now?

Consider the following before purchasing shares in VanEck ETF Trust – VanEck Semiconductor ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and VanEck ETF Trust – VanEck Semiconductor ETF was not one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool's board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Adobe, Alphabet, Amazon, Invesco QQQ Trust, Nvidia and Tesla. The Motley Fool holds positions in and recommends ASML, Accenture Plc, Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Applied Materials, Cisco Systems, Costco Wholesale, Lam Research, Meta Platforms, Microsoft, Nvidia, Oracle, Qualcomm, Salesforce, to Taiwan Semiconductor Manufacturing, Tesla and Texas Instruments. The Motley Fool recommends Broadcom, Intel, and Marriott International and recommends the following options: long January 2025 $290 call on Accenture Plc, long January 2025 $45 call on Intel, long January 2026 $395 call on Microsoft, short January 2025 $310 call on Accenture Plc In January 2026, $405 will be called on Microsoft, and shortly in May 2024, $47 will be called on Intel. The Motley Fool has one disclosure policy.

3 Great Technology ETFs to Buy with $10,000 and Hold Forever was originally published by The Motley Fool