Investors should look for broken stocks, not broken companies. That's one of my favorite investing rules, and if you follow it successfully, you can make a lot of money. So which label applies to coffee chain giant Starbucks (NASDAQ:SBUX)?

The stock has been on a prolonged slide and is more than 40% below its previous high after a poor reception to its fiscal second-quarter earnings report. The current decline is the worst since the 2008 financial crisis.

There's no doubt that Starbucks is struggling, but there are some essential facts you need to know before writing off the company. In fact, Starbucks could be a buy-and-hold forever share, despite the current problems.

Starbucks' struggle is not unique

A look at Starbucks' Q2 2024 results tells a pretty quick and compelling story. The number of company-wide transactions fell 6% year-over-year this quarter, and international sales, with China being a big part of the company's growth strategy, fell 6%. Management dramatically lowered full-year revenue growth expectations from 7% to 10% to a low single-digit range.

The coffee chain appears to be cracking in the face of macroeconomic uncertainty. During the earnings call, CEO Laxman Narasimhan noted: “Across a number of key markets, we continue to feel the impact of a more cautious consumer, especially among our more occasional customers. And a worsening economic outlook has weighed on customer traffic, an impact felt broadly across the industry.”

Fellow consumer-facing brand McDonald's also missed analysts' earnings estimates for the most recent quarter. Management spoke similarly about how consumers are cutting back on spending.

A meal or coffee on the go is a luxury that many people will give up when finances get tight. Consumer credit card debt is at an all-time high, and household savings rates are at nearly a decade low. Meanwhile, inflation has been persistent in recent months, supporting the idea that people are struggling to make ends meet.

The good news is that this isn't an indictment of Starbucks as a company or a brand: people are closing their wallets across the board. This temporary storm should pass as the economic cycle turns and consumers get back on their feet.

Focus on the fundamentals

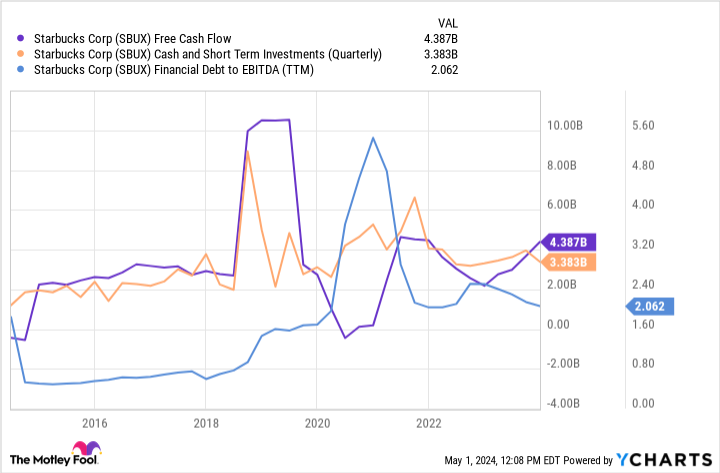

Investors should be aware of these headwinds, but keep an eye on Starbucks' fundamentals. This is where the company excels. Keep in mind that sales should still grow this year, even if not as much as initially expected. Starbucks also grew its U.S. rewards program 6% year-over-year to 32.8 million members last quarter. The company is a solid financial company with more than $3 billion in cash on the balance sheet and a leverage ratio of just 2 times EBITDA.

Don't forget the company's ability to return cash to shareholders. Starbucks is a solid dividend growth stock; the company has increased its dividend for fourteen years in a row payout ratio is a healthy 63%. Meanwhile, the company has repurchased enough shares to reduce its share count by 6% over the past five years, boosting earnings per share.

Starbucks may temporarily feel consumer disengagement, but the company is still fantastic.

An attractive price thanks to the decrease

Big companies are rarely cheap, which is part of the reason why investors should look closely at blue chip stocks like Starbucks when they stumble. It could be a rare buying opportunity. Starbucks is trading at a price-to-earnings (P/E) ratio of 22, after a 41% decline from the previous high.

Analysts believe the company will grow earnings by an average of about 15% per year over the next three to five years. For 22 times earnings, investors can get double-digit earnings growth, a growing dividend that yields 3%, and a financially stable company that has weathered multiple recessions over its history.

Consumers are having a hard time right now, but that won't last forever. Starbucks' low valuation provides an excellent starting point for solid long-term returns.

Should You Invest $1,000 in Starbucks Now?

Before you buy shares in Starbucks, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Starbucks wasn't one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Starbucks. The Motley Fool has one disclosure policy.

1 Beautiful S&P 500 Dividend Stock Down 41% to Buy and Hold Forever was originally published by The Motley Fool